“Bonds vs Equity – Kaha Karein Invest?”

“Bonds vs Equity – Kaha Karein Invest?”

Aksar investors apna surplus paisa invest karne se pehle sochte hain ki, fixed income – bonds mai invest karein ya phir, equity mai. Waise toh dono hi options sahi hai, lekin, agar inke annual returns dekhein toh kaafi difference hai – jahan bond ka ek average annual return possibility kuch 4 se 7% hota hai, wahin agar aap ek reputed equity mai invest karte hain for long term, toh aapko kaafi acha returns milta hai. For instance, Tata Steel ka 3 year returns 188% hai.

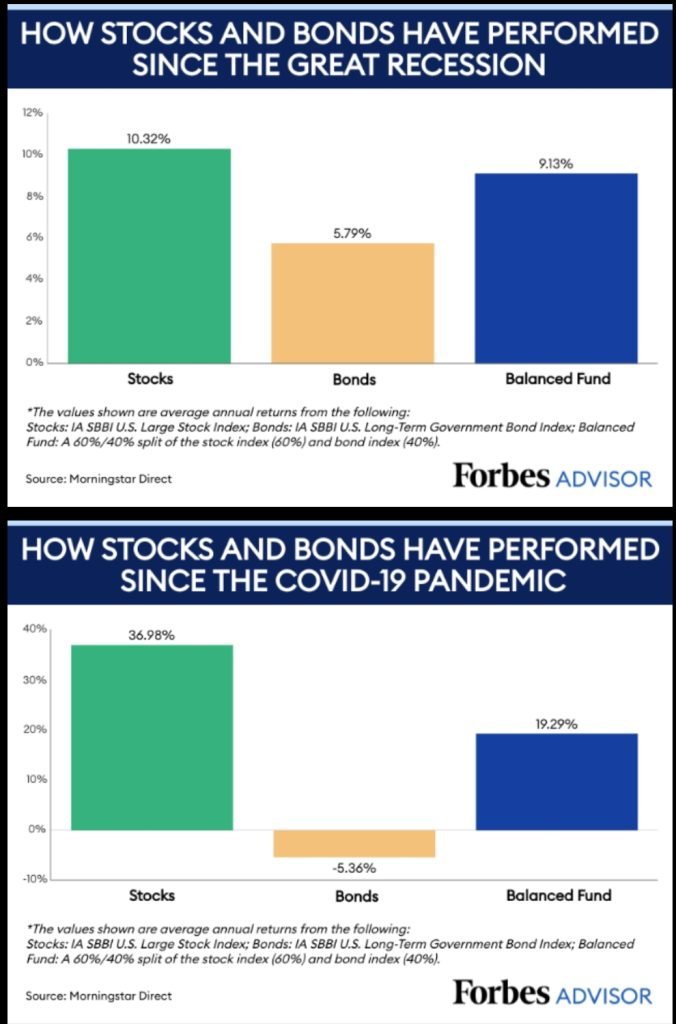

Historically bhi dekha jaye toh, returns ke maamle mai, equity hamesha bonds se strong hi raha hai..

Toh aayie chaliye compare karte hai bonds aur equity ko detail mai…

Sabse pehle hum dono ke basic definition ko samajh lete hain.

Equity mai investors company ke shareholder ban jaate hain aur unhe equity shares ke basis pe company ka part ownership bhi mil jaata hai. Ab yeh shares badhenge toh shareholders ka capital appreciate hota hai aur agar dividend distribute kia toh dividend bhi milta hai.

Bonds mai investors company ko ek principal amount loan par dete hai aur uss loan ka unhe fixed interest milta hai. Tenure khatam hone par unhe unka principal amount bhi mil jaata hai.

🔴🔴 To OPEN FREE Demat Account, Click 👇👇 Link http://bit.ly/AngelOneST

Ab dekhte hain kuch important differences bonds aur equity ke beech mai –

| Difference Parameter | Equity | Bonds |

| Types | Company equity shares, Bonus shares, Employee Stock Options | Government Bond, Corporate Bonds, Municipal Bonds |

| Returns | The return percentage depends upon the stock’s appreciation. It can increase or decrease. | The return percentage is fixed here |

| Dividends | Companies may distribute yearly dividends. | There are no dividends here. |

| Risk-o-meter | Riskier than bond | Low risk |

| Liquidity | Highly liquid. You can buy and sell equity shares as and when you want on the stock exchanges | Less liquid than equity |

| Who Should Buy? | Aggressive investors who want to increase their principal amount significantly in long run | Conservative Investors who want regular interest amount on their principal amount |

| Investment Tenure | 5 to 10 years, 10 to 30 years | 1 day to Long-term. The longer you keep, the better percentage yield you get.. as you average out the market volatility |

| If the worst happens | Shareholders are the last person to get paid in case of bankruptcy | As lenders, bond holders are paid a on priority basis in case of bankruptcy |

Bonds ya Equity? Choosing the Right Investment

Chahe aap bond mai invest kar rahe hain ya shares mai, bohut important hai ki aap apna risk tolerance pehle se hi measure kar lein. Kabhi bhi invest karte wakt ek thumb rule yaad rakhein – Do not invest what you cannot afford to lose. Isiliye aksar professional advisor ya experts’ consultancy kaafi zaroori hai..kyunki who kaafi behtar tarike se aapke investment ko diversify karte hain aapke risk ke hisaab se.

AngelOne ShoutOut

Toh agar aapko stock market mai apna paisa badhana hai, equity aur bonds dono mai invest karna hai, aur apna portfolio bhi proper balanced rakhna hai, toh bohut important hai ki aap,“Best investment partner choose kijiye, AngelOne ke saath apna demat account kholiye” Yahan aapko best offers bhi milenge aur experts advise bhi.

December month AngelOne offers

Offer of the month for B2C customers

- Enjoy zero brokerage on all orders for the first 30 days

- Avail zero interest charges on MTF trading for the first 30 days

Account opening charges, brokerage and AMC for B2C customers

- Create a Demat Account for Free

- Enjoy ₹0/- Brokerage on Delivery Trades & ₹20/- Brokerage on Intraday, F&O, Currencies & Commodities

- Free AMC for first year

Now, Why Angel One is the Best Place to Trade and Invest?

Angel One naa sirf desh ka number 1 Full-Service Broker hai balki ab ek Fully Functional Fintech company bhi hai.

Jee haan, AngelOne ke saath apna Demat account open karein, aur alag alag technical aur data-related features ka advantage lein – jaise ki SmartMoney, Smart Store, TradeBuddy. Along with best facilities, jaise ki –

- Smallcase

- Robo Order

- SmartAPI

- Personalized advisory

- MTF Facility

In sab ka fayda lene ke liye, description me diye gaye link ko click kijiye aur apna Free Demat Account aaj hi open kijiye. AngelOne, India ka experienced hi nahi balki currently top 4 stock broking companies mai se ek hai – aur yahan aap na sirf equity market mai balki commodity aur F&O mai bhi trading kar sakte hain, easily, safely aur securely.