IDFC Bana Desh ke Top 10 Bank me se ek – Journey of IDFC Bank”

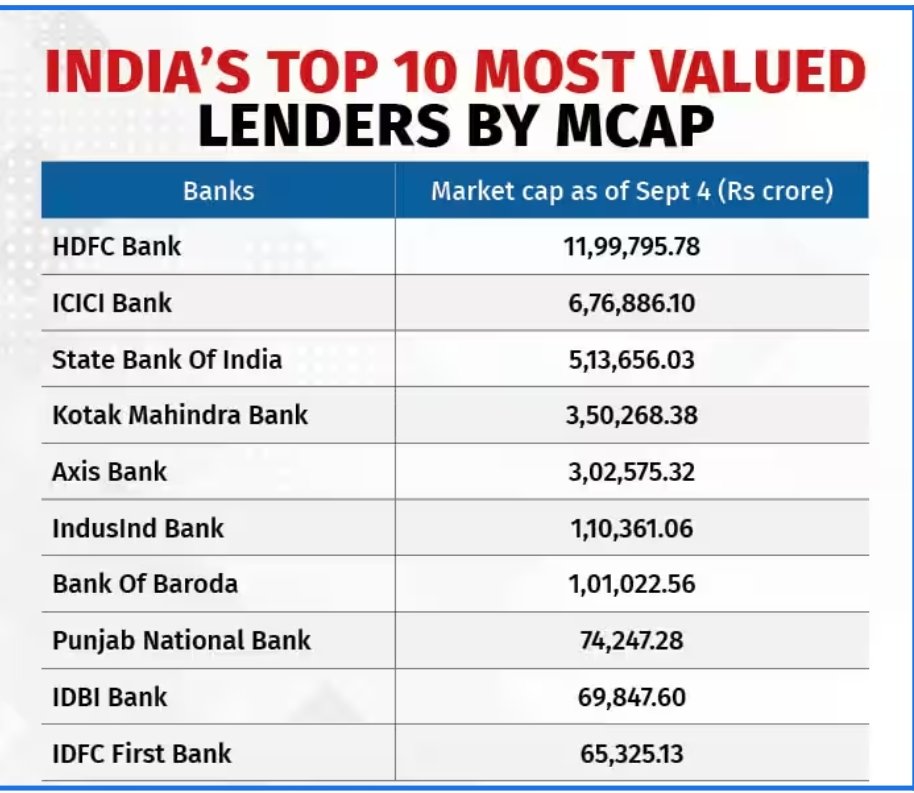

Trending study: Rs 65,251 crore ke market cap ke saath IDFC First bank apne 8 saal ke career mai hi ban gaya hai India ka top 10 bank…Jee haan, 100 par pahuchte hi, IDFC First bank Top 10 valuable lender ke elite club mai aa gaya hai, aur itna n=hi nahi bank ne Union Bank aur Canara Bank ko bhi peeche chod dia hai…

Iss saal IDFC First bank 67% bhada hai aur Sept 4 ko jaise hi GQG Partners ke Rajeev Jain ne 17.1 crore shares or 2.58 percent stake buy kiye kuch Rs 1,527 crore se, toh bank aur 5% badha…

Kaafi acha progress hai na?

Aayie chaliye dekhte hain IDFC Bank ki Story Shuruwaat se

1997 mai Government of India ne IDFC Limited banaya jo infra projects ko finance karne lagi. Fir 2005 mai yeh company Indian stock market mai list hui..2014 mai RBI ne company ko banking license grant kia, aur phir October 2015 mai khula IDFC First Bank, ek private bank jo 8 saal mai hi desh ke top 10 bank mai se ek hai…

Bank ne shuruwaat ki thi sirf 23 brances se lekin 1.5 saal mai 100 branches par pahuch gayi thi.

2017 mai IDFC pehli bank thi jo Aadhaar-linked cashless merchant solution de rahi thi.

Jee haan bank ne slowly aur steadily kaafi progress kiya hai.. Aayyie chaliye dekhte hain company ke fundamentals aur technicals June Quarter mai apne net interest income mai bank ne 36% surge dikhaya tha aur overall income 49%, net profit bhi 61% up tha..Bank ka RoA aur RoE bhi improve hua – from 0.97% to 1.25 percent aur 8.96 % se 11.78%. Cost-to-income ratio bhi 71 percent tha..

CASA ratio bank ka 46.47 percent hai jo bade bade lender se bhi high hain including State Bank of India, Axis Bank, HDFC Bank and ICICI Bank.Iss current position par ICICI Securities ne ‘add’ rating dia hai stock ko with a target price of Rs 105 a share – valuing the stock at 2.2x March 2025 estimates of adjusted book value.

Investment Rationale

AngelOne ShoutOut

Toh agar aapko progressing bank mai invest karke apna paisa badhana hai, ya phir rightly valued company/IPO mai invest karna hai, toh bohut important hai ki aap,”Best investment partner choose kijiye, AngelOne ke saath apna demat account kholiye”

Angel One mai aapko milega trading ke liye ek superfast naya app Angel Spark

Jahan aap ek hi app mai alag alag instruments mai invest kar sakte hain, derivates, currency, bonds aur wo bhi bohut hi fast. Iske alawa, iss app ka user interface kafi acha hai aur achi baat yeh hai ki it is made in a very simplistic manner so that any user can easily use the app without any issue.

App par intraday trading tips, short term tips milta hai without paying anything extra. Iske alawa app kar learning center bhi hai jahan investors knowledge seek kar sakte hain bina koi fees diye.

Toh aaj hi Playstore mai jaiye aur AngelOne ka latest Angel Spark app download kijiye..

September month AngelOne offers

Offer of the month for B2C customers

· Enjoy zero brokerage on all orders for the first 30 days

· Avail zero interest charges on MTF trading for the first 30 days

Account opening charges, brokerage and AMC for B2C customers

Create a Demat Account for Free· Enjoy ₹0/- Brokerage on Delivery Trades & ₹20/- Brokerage on Intraday, F&O, Currencies & Commodities· Free AMC for first year

Now, Why Angel One is the Best Place to Trade and Invest?

Angel One naa sirf desh ka number 1 Full-Service Broker hai balki ab ek Fully Functional Fintech company bhi hai.

Jee haan, AngelOne ke saath apna Demat account open karein, aur alag alag technical aur data-related features ka advantage lein – jaise ki SmartMoney, Smart Store, TradeBuddy. Along with best facilities, jaise ki –

- Smallcase

- 2. Robo Order

- 3. SmartAPI

- 4. Personalized advisory

- 5. MTF Facility

In sab ka fayda lene ke liye, description me diye gaye link ko click kijiye aur aaj hi Angel One ka Angel Spark download kijiye. AngelOne, India ka experienced hi nahi balki currently top 4 stock broking companies mai se ek hai – aur yahan aap na sirf equity market mai balki commodity aur F&O mai bhi trading kar sakte hain, easily, safely aur securely.